Real Estate Insurance Reinvented

Better coverage in a fraction of the time at a fraction of the cost

More Clarity, Less Worry

We're bringing simplicity and transparency to the real estate insurance space for condo associations (HOAs), building owners, property managers, and developers everywhere.

This is what we do. This is all we do.

Who We Cover

Condo and

Homeowner Associations

(COA/HOA)

Building Owners

Property Managers

Developers

Everything On Your Terms

When you take an intuitive, digital approach to real estate insurance and you combine that with our best-in-class insurance coverage, you’ve now got more quotes, more options, and more savings — all tailored to your needs and delivered instantly

Instant Quotes

Free, no hassle quotes at the click of a button. No more fax machines, long telephone calls, and long unreadable forms.

Online Everything

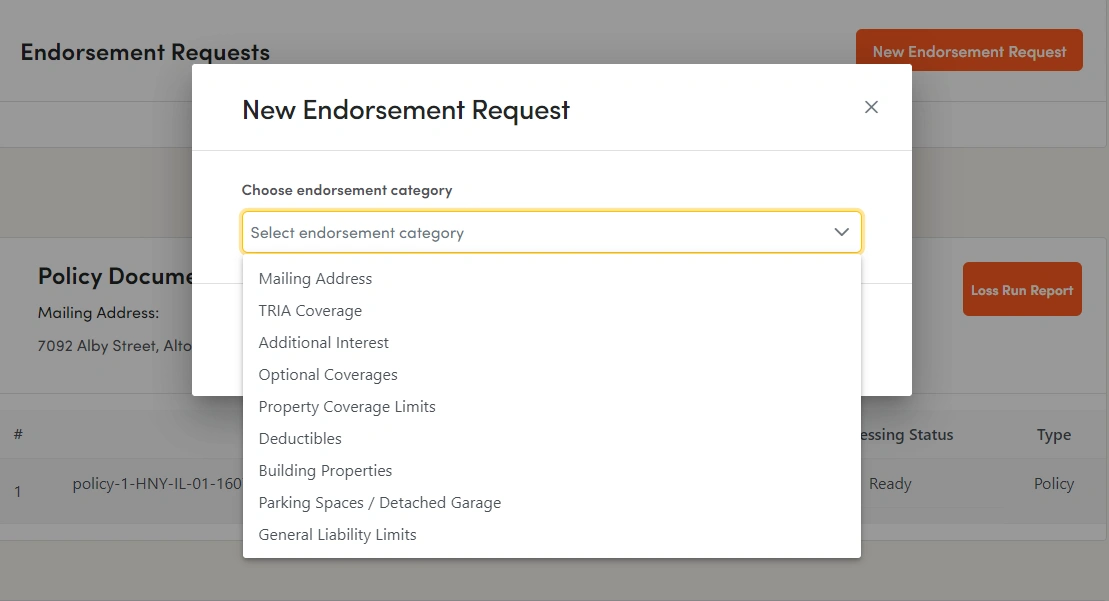

Access to quotes, binders, policy forms, and all endorsements 24/7. Unit owners and tenants get direct access to download their insurance certificates from our site.

Up to 40% Savings

Our unique offering combines proprietary technology with unlimited expert advice to help you find the best coverage at the most affordable price.

Unlimited Expert Advice

If you have any questions at any point of the way, our top experts would be happy jump on a phone call with you and provide tailored guidance.

Fully Customizable Coverage

Using AI, our Inspector App gives you the power to get insured in a fraction of the time it takes elsewhere — all without anyone having to visit in-person.

Instant Capture

Got a sec? Snap a few quick property pics and we’ll give you a quote in a flash.

Total Transparency

We want you feeling secure knowing where every penny of what you pay goes towards. From start to finish, you control the process.

Unique Discounts

With us, you only pay for what you need. With the option to customize your policy in real time, we're able to offer better bang for your buck.